LET’S LEARN THE ACTUAL HOW SHARE MARKET WORKS.

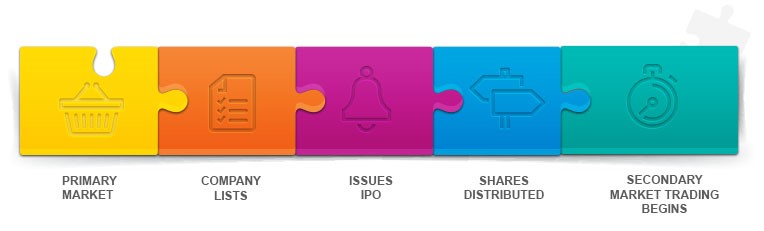

- A company gets listed in the primary market through an IPO.

- Shares get distributed in the Secondary Market

- The stocks issued can be traded by traders in the secondary market.

- You can buy a share of interest through a company with an account with the stock exchange.

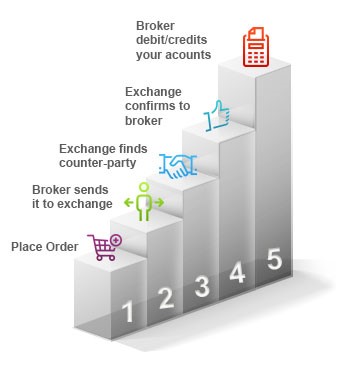

- If your broker passes on your buy order, the exchange will search for a sell order to match that buy order.

- Share transfers take two days, but they transfer them to your brokerage account instead of to your Demat account.

- The stock market is one of the world’s largest and most important ways to invest money. It is often seen to be a gamble because any given stock could rise or fall, but it’s not a gamble if you know how the system works. Read about Functions Of The Stock Market.

STOCK MARKET PARTICIPANTS:

In this post, we learn How share market works.in the last section, you learned about the different participants in a stock market and other basics. Let’s explore how this connects and understand what an economy looks like.

Stock exchanges are the platform through which people offer, buy and sell financial instruments. Participants of the stock exchange must be registered with the Securities and Exchange Board of India (SEBI) to conduct trades. This includes companies issuing shares, traders, investors, brokers conducting the trades and any other participants. All of these regulations are created by SEBI.

Read more about Why Investing In The Stock Market Is A Smart Move

First, a company does an Initial Public Offering to list on the main market (IPO). It provides information about the business, the shares being issued, and other details in its offer document. Stocks issued in the primary market are distributed to investors who have placed bids for them during the listing.

Traders in the secondary market are looking to buy or sell stocks issued by a company. This is where most of the trading is done, making it a hotbed for transactions were trades can be made to make profits or cut losses.

Stockbrokers and brokerage firms are entities that allow you to invest in stocks. They act as an intermediary between you, the investor, and the stock exchange.

Your broker searches for a buyer and a seller that match the order you placed. Once this is found, a price is agreed on and confirmed with the broker.

This helps you, the user. However, there are other people who are involved in your experience. The brokers, who buy and sell stocks on behalf of investors, have to first process their order and then send it to an exchange where trade representatives match buyers with sellers. the process can be finished within minutes.

HOW YOUR ORDER IS PROCESSED.

There are tens and thousands of investors. With none of them able to all converge in one location for trades, brokerage firms play a major role in enabling trades to be made without the need for each investor to carry out their own transaction.

When you place an order to buy a share at a specific price, it is processed by your broker at the exchange.

When someone buys or sells stocks through the exchange, they have to confirm the details of the person they are buying from. They also have to make sure they don’t default on their promise. After that is done, the exchange facilitates the transfer of ownership of shares, a process called settlement. Previously, it used to take weeks for a trade to settle, but now it only takes hours.

A trade that was done today will be deposited in the Demat account of the seller by tomorrow, meaning two working days.

The by-product of this process is the initial trade, which guarantees that the terms set for the trade are honored on settlement day. If it isn’t, then investors would no longer want to trade on the market because their trades might not be honoured.

When there is a change in the price of shares, it’s due to the buyer’s perceived value. This is reflected in demand, which can rise due to an increase in buy orders. The bigger the volume of trade, the greater will be stock fluctuations in prices.

For this reason, it can be difficult to find investors because there are many traders that don’t converge in one place. Stock brokers provide services to help clients conduct their trades and make a deal.

The process is as follows: once you place an order to buy a particular share at a said price, it is processed through your broker at the exchange. Multiple parties are involved in behind-the-scenes.

With a time-efficient AI, the transfer of ownership of shares can happen in minutes. Earlier, settlements would take weeks.

This has been brought down to two days. For example, if you conducted a trade today, you will get your shares deposited in your Demat account the day after tomorrow.

The stock exchange ensures trades are honored. If a trade is not honored, people may not trust the underlying market and believe that other trades may not be honored.

Demand for shares of a particular stock can affect the price and will be reflected in the change in volume or volume.

HOW TO INVEST IN SHARES:

Five steps investors need to take to invest in the share market

Step 1. Know your investment requirements & limitations

The requirements you need to create an investment should be future-oriented instead of present-facing.

If you earn Rs. 20,000 a month, your limitations may be that you must set aside Rs. 10,000 for installment payments for your car and another Rs. 5,000 for monthly expenses.

The leftover money could go to fixed deposits or low-risk stock, but you need to consider how that would affect your taxes.

The capital gains tax you incur while selling your shares after a year is not applicable if you sell them before one year.

So, don’t sell your stocks too quickly, even if you need money– it could cost you in the future to buy them back.

Financial Planning will help you plan your finances.

Step 2. choose an investment strategy

Once you have an understanding of your investment profile, analyze the stock market to determine what stocks are right for you. If we continue the above example, with a budget of Rs 1,000, you can either choose to buy one large-cap stock or multiple small-cap stocks. For a more steady income, opt for high-dividend stocks.

Research upcoming stocks that are likely to be the most valuable in the future. Collecting a diverse range of stocks is a good investment strategy.

A step-by-step guide to build your perfect financial plan.

Step 3. Enter the market at the right time

Rather than following your “gut instinct” and buying or selling at random, do your research. It’s important to know when to buy and sell shares for maximum profit. Unlike animals of prey who wait for the perfect time, you’ll have to spend time doing research in order to buy low and sell high.

Step 4: Execute the trade

Make your trade online or on the phone to make sure it’s confirmed, and double-check before finalizing.

step 5. monitor your portfolio

As the stock market is dynamic, make sure that you keep an eye on your portfolio. Keep in mind that companies may not be as profitable as you thought – pay attention to their income statement and other metrics before investing.

This doesn’t mean you should panic; the stock will always fall at some point. A market participant with a shorter time horizon than yours will eventually sell his stock and make a profit. Patience is key in the markets.

We Hope you All Like This Post If you Like Please Share the Post With your Family & Friends.

Wait Okbet is hiring? Okbetcareers? Interesting. Anyone know what it’s like working there? Good benefits? Might be worth a look if they’re legit. Thinking of applying now after seeing okbetcareers.