Ahead of the biggest bitcoin options expiry in history, Bitcoin (BTC) has been wildly fluctuating over the past few hours, ranging from $92,500 to $94,000. Earlier this morning, it reached $92,800. The open interest (OI) in $14 billion worth of bitcoin options is scheduled to expire this Friday.

The Expiration of $14 Billion in Bitcoin Options Could Change the Course of 2024?

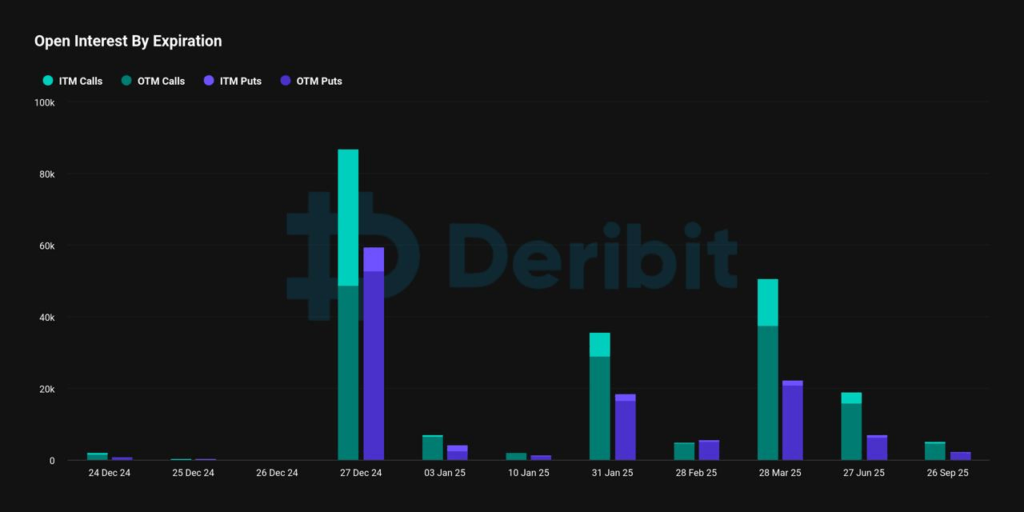

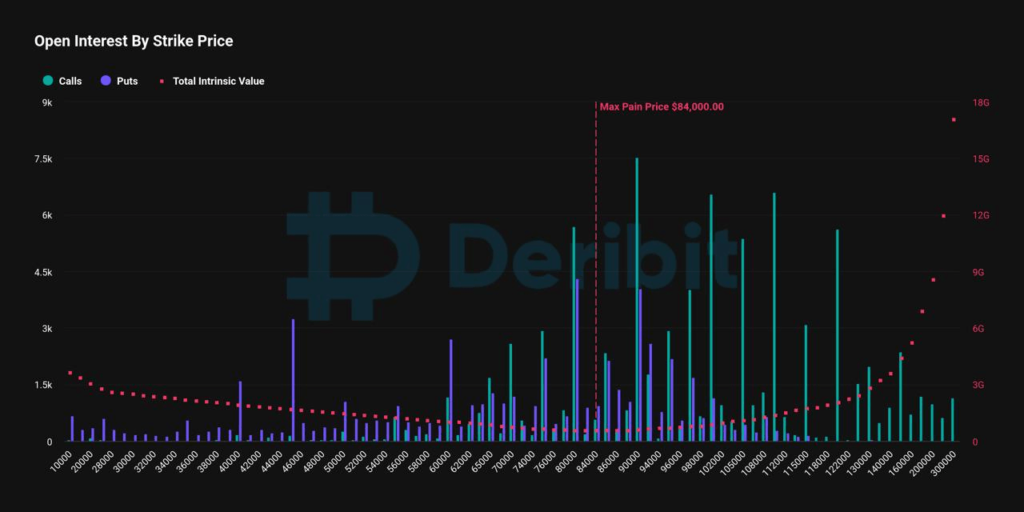

The CEO of Deribit, Luuk Strijers, revealed in a letter to Bitcoin.com News that the put-call ratio for the expiry is 0.69, meaning there are seven puts for every ten calls. With 146,000 contracts remaining, December’s expiry dwarfs others, he said, and it doubles the next largest expiry in March 2025, which holds 73,000 contracts.

According to Strijers, the expiration this Friday accounts for 44% of the $32 billion total amount of bitcoin options that are currently on the market. More than $4 billion worth of these contracts are anticipated to expire in the money, according to Deribit, the top cryptocurrency options exchange in the world. This development is likely to spark a lot of trading activity.

Although 2024 has been a bullish year for bitcoin, the impending expiration is clouded by uncertainty. Increased volatility highlights the unstable market sentiment, as evidenced by the notable swings in Deribit’s DVOL index.

“A fantastic year for the bulls is about to come to an end with the highly anticipated annual expiry,” Strijers informed our news desk.

The CEO of Deribit also said:

Additionally, Strijers stated that “the market is highly leveraged to the upside, as the previously dominant bullish momentum has stalled.” In the event of a large downside move, this positioning raises the possibility of a quick snowball effect. Since it could influence the story going into the new year, everyone is watching this expiry.

Beyond its immediate ramifications, this historic expiry offers important insight into sentiment and positioning as the year moves into 2024.