The market is appearing signs of sustainable up move. The upside levels to observe over the following one or two weeks are 18,350 and 18,600, Nagaraj Shetti of HDFC Securities said

NOVEMBER 09, 2022 / 12:47 AM IST

Buying within the final 90 minutes of the session made a difference in the Clever recovery of the day’s misfortunes and nearly half a percent higher on November 7. All sectors, barring pharma, took an interest in the rally.

The Sensex closed 235 focuses higher at 61,185, whereas the Clever rose 86 focuses to 18,203 and shaped a Doji design on the everyday charts, showing uncertainty among bulls and bears approximately the showcase trend.

“Normally, an arrangement of Doji at the highs calls for caution for long positions. But an economical move over the tall of Doji at 18,255 levels is likely to invalidate the negative effect of the design,” Nagaraj Shetti, Specialized Inquire about Investigator at HDFC Securities, said.

The short-term slant proceeds to be positive, he said.

The market is presently appearing signs of a maintainable move. Other upside levels to observe over the other one or two weeks are 18,350 and 18,600, Shetti said. The quick back is at 18,100.

The broader markets moreover picked up force with the Clever Midcap 100 and Smallcap 100 files rising 0.8 percent each. India VIX, the instability record, fell 0.44 percent to 15.59 levels, making the drift positive for the bulls.

We have collated information focuses to assist you to spot beneficial trades:

Note: The open intrigued (OI) and volume information of stocks in this article are the totals of three-month information and are not fair for the current month.

The key back and resistance levels on the Nifty

As per the rotate charts, the key back for the Clever is set at 18,101, taken after by 18,056 and 17,984. In case the file moves up, the key resistance levels to be careful of are 18,247, 18,292, and 18,365 .

Nifty Bank

The Clever Bank revived more than 400 points, or 1 percent, to shut at 41,687 and shaped a small-bodied bearish candle on the everyday charts on November 7. The level of 41,328 will act as a significant bolster taken after by 41,328 and 41,159. On the upside, key resistances are at 41,770 taken after by 41,874 and 42,043.

CALL OPTION DATA

The greatest Call open interest of 23.4 lakh contracts was seen at the 19,500 strikes, which can act as a vital resistance level within the November series. This is taken after 19,000 strikes, which hold 22.37 lakh contracts, and 18,000 strikes, which have more than 19.11 lakh contracts. Call composing was seen at 18,200 strikes, which included 2.68 lakh contracts, taken after by 19,000 strikes which included 2.06 lakh contracts, and 18,400 strikes which included 1.17 lakh contracts.

PUT OPTION DATA

The most extreme Put open intrigued of 36.3 lakh contracts was seen at 17,000 strikes, which can act as a vital bolster level within the November series.

This is taken after 18,000 strikes, which holds 26.87 lakh contracts, and 17,500 strikes, which has collected 23.77 lakh contracts. Put composing was seen at 18,200 strikes, which included 3.96 lakh contracts, taken after by 17,100 strikes, which included 2.56 lakh contracts, and 17,600 strikes which included 1.55 lakh contracts. Put unwinding was seen at 18,000 strikes, which shed 2.49 lakh contracts, taken after by 17,200 strikes which shed 1.36 lakh contracts, and 16,900 strikes which shed 1.18 lakh contracts. Call unwinding was seen at 18,000 strikes, which shed 4.02 lakh contracts, taken after by 18,100 strikes which shed 2.44 lakh contracts, and 18,500 strikes which shed 1.93 lakh contracts.

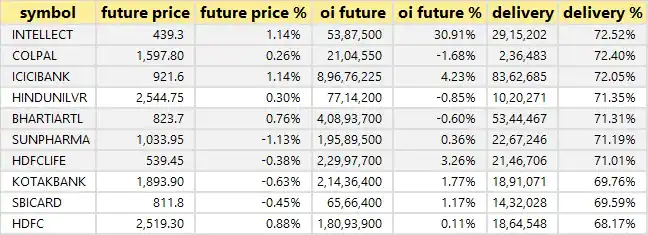

Stocks with a high delivery percentage

A high delivery percentage recommends that financial specialists are appearing intrigued by these stocks. The most elevated conveyance was seen in the Judgment skills Plan Field, Colgate Palmolive, ICICI Bank, Hindustan Unilever, and Bharti Airtel, among others.

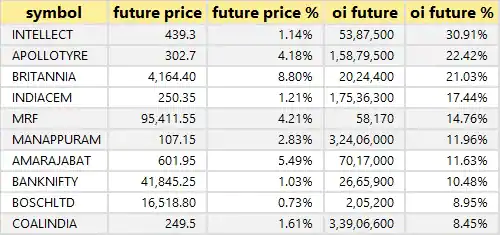

Stocks see long build-up

An increment in open interest, alongside an increment in cost, shows a build-up of long positions. Based on the open interest future rate, here are the Best 10 stocks in which a long build-up was seen:

stocks saw long unwinding

A decrease in open interest, at the side a decrease in cost, for the most part, shows a long loosening up. Based on the open interest future rate, here are the Beat 10 stocks in which long unwinding was seen:

stocks see short build-up

An increment in open interest, alongside a decrease in cost, for the most part, indicates a build-up of brief positions. Based on the open interest future rate, here are the best 10 stocks in which a brief build-up was seen:

stocks see short-covering

A decrease in open interest, at the side an increment in cost, for the most part shows a short-covering. Based on the open intrigued future rate, here are the Best 10 stocks in which short-covering was seen:

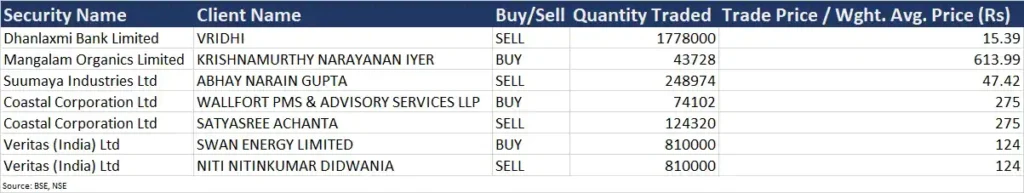

Bulk Deals

Veritas (India): Swan Vitality bought an extra 8.1 lakh value offers within the company through open advertising exchanges. These offers were procured at a normal cost of Rs 124 a share. Promoter Niti Nitinkumar Didwania was the seller

1win Aviator APK download for fast gaming

Try your luck at BitStarz, claim your welcome bonus of 5 BTC and 180 free spins, with top-rated VIP rewards. Access via working mirror site.

Bet smarter with our aviator game review

No VPN needed when you have a casino mirror

💼 Микрокредит займ на бизнес

Регистрируйся в Lucky Star — получи фриспины для Лаки Джет!

Casino mirror offers a safe route back to the lobby

В этой публикации мы сосредоточимся на интересных аспектах одной из самых актуальных тем современности. Совмещая факты и мнения экспертов, мы создадим полное представление о предмете, которое будет полезно как новичкам, так и тем, кто глубоко изучает вопрос.

Разобраться лучше – https://vyvod-iz-zapoya-1.ru/

Casino mirror gives full access to your favorite casino

Reviews highlight Lucky Jet and see why it’s popular.

Casino mirror restores full-site functionality in seconds.

Например, если речь идет о выводе из запоя, врач проведет тщательное обследование пациента, чтобы определить общее состояние здоровья и наличие возможных осложнений. На основе диагностики будет назначена инфузионная терапия, которая включает введение растворов, витаминов и препаратов для снятия абстиненции.

Выяснить больше – нарколог на дом срочно красноярск

Запой и алкогольная интоксикация – это состояния, при которых организм уже не способен самостоятельно справиться с токсинами. Попытки выйти из запоя без медицинского вмешательства могут привести к серьёзным осложнениям, таким как скачки давления, судороги, галлюцинации и даже алкогольный психоз.

Детальнее – нарколог капельница на дом иркутск

Каждый пациент проходит предварительное обследование: экспресс-анализ крови на электролиты, биохимия печени и почек, ЭКГ. На основании результатов врач формирует персональную программу инфузионной терапии.

Углубиться в тему – вызвать капельницу от запоя в челябинске

Медикаментозная детоксикация позволяет быстро и безопасно очистить организм от токсинов и продуктов распада алкоголя или наркотиков, минимизируя риски осложнений. Используются препараты, которые восстанавливают работу печени, почек и других органов, а также нормализуют электролитный баланс.

Исследовать вопрос подробнее – наркологическая клиника клиника помощь в мариуполе

При обращении по телефону или через сайт диспетчер уточняет ФИО пациента, адрес, краткую историю запоя и наличие хронических заболеваний. Затем он передаёт информацию дежурному наркологу, который готовится к выезду.

Получить дополнительные сведения – запой нарколог на дом ростов-на-дону

Круглосуточная служба «ЧелябМед» оперативно реагирует на экстренные случаи при следующих состояниях:

Подробнее тут – http://vivod-iz-zapoya-chelyabinsk13.ru

Капельницы с растворами электролитов, витаминов, глюкозы и гепатопротекторов обеспечивают быстрое восстановление водно-солевого баланса, детоксикацию и поддержку печени. Инфузионное лечение позволяет нормализовать артериальное давление и сердечный ритм.

Разобраться лучше – срочный вывод из запоя в ростове-на-дону

Оказание наркологической помощи в домашних условиях имеет ряд нюансов. Пациент находится в знакомой среде, что снижает уровень тревоги и позволяет легче переносить лечебные процедуры. При этом специалист оснащён необходимым оборудованием для экстренной помощи, что важно при рисках осложнений. Поддержка близких дополнительно повышает эффективность терапии.

Получить дополнительные сведения – врач нарколог выезд на дом волгоград

Наркологическая клиника в Ростове-на-Дону предоставляет полный спектр услуг по диагностике, лечению и реабилитации пациентов с алкогольной и наркотической зависимостью. Применение современных медицинских протоколов и индивидуальный подход к каждому пациенту обеспечивают высокую эффективность терапии и снижение риска рецидивов.

Получить дополнительные сведения – наркологическая клиника лечение алкоголизма

Алкогольный запой — это не просто последствие длительного употребления спиртного, а состояние, которое может привести к необратимым последствиям без своевременного медицинского вмешательства. Длительная интоксикация вызывает нарушения в работе печени, сердца, почек, приводит к обезвоживанию, сбою электролитного баланса, а также провоцирует серьёзные психоэмоциональные изменения. Самостоятельный отказ от алкоголя может стать причиной опасных осложнений: судорог, гипертонических кризов, панических атак и даже алкогольного психоза.

Детальнее – http://vyvod-iz-zapoya-arkhangelsk6.ru

Самостоятельно выйти из запоя — почти невозможно. В Екатеринбурге врачи клиники проводят медикаментозный вывод из запоя с круглосуточным выездом. Доверяйте профессионалам.

Получить дополнительные сведения – срочный вывод из запоя в екатеринбурге

Когда организм на пределе, важна срочная помощь в Екатеринбурге — это команда опытных наркологов, которые помогут быстро и мягко выйти из запоя без вреда для здоровья.

Углубиться в тему – вывод из запоя цена свердловская область

Если вовремя не принять меры, состояние может усугубиться, повышая риск серьёзных осложнений. Наиболее эффективным способом очищения организма является постановка капельницы, которая помогает быстро стабилизировать состояние. Клиника «Курс на ясность» оказывает экстренную наркологическую помощь с выездом врачей на дом 24/7.

Подробнее – капельница от запоя цена красноярск

Наша клиника работает по стандартам международного уровня, сочетая научно обоснованные методики с внимательным отношением к каждому пациенту. В «ВолгаМед» вы не столкнётесь с бюрократией или очередями — помощь оказывается сразу после обращения, а все процедуры проводятся в строгом соответствии с медицинскими протоколами и этическими нормами.

Подробнее тут – https://narkologicheskaya-klinika-volgograd13.ru/chastnaya-narkologicheskaya-klinika-volgograd

В момент вызова важно сообщить:

Получить дополнительную информацию – запой наркологическая клиника

Для детоксикации используются современные препараты и методы введения, позволяющие быстро нейтрализовать токсическое воздействие:

Подробнее – лечение наркомании реабилитация

Как подчёркивает главный врач клиники Кондратьев И.Л., «своевременный выезд нарколога на дом снижает риски осложнений и повышает шансы на полное восстановление пациента».

Углубиться в тему – http://

Для срочных случаев клиника поддерживает круглосуточный режим приёма заявок. После оформления вызова диспетчер передаёт информацию бригаде, и в течение часа врач прибудет по указанному адресу.

Ознакомиться с деталями – вывод из запоя на дому цена в мариуполе

Важным этапом работы клиники является всесторонняя диагностика состояния пациента. Используются лабораторные и инструментальные методы обследования для оценки влияния токсических веществ на организм. Такой подход позволяет составить индивидуальный план лечения, максимально учитывающий особенности пациента и стадию зависимости. Подробные рекомендации по диагностике зависимости опубликованы на сайте ФГБУ «НМИЦ Психиатрии и наркологии» Минздрава России.

Детальнее – https://narkologicheskaya-klinika-chelyabinsk13.ru/platnaya-narkologicheskaya-klinika-chelyabinsk

Когда организм на пределе, важна срочная помощь в Екатеринбурге — это команда опытных наркологов, которые помогут быстро и мягко выйти из запоя без вреда для здоровья.

Получить дополнительные сведения – vyvod-iz-zapoya-czena ekaterinburg

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Узнать больше – наркология вывод из запоя в екатеринбурге

Без медицинской помощи запой может перерасти в тяжёлую форму алкогольной интоксикации, вызывая серьёзные сбои в работе всех систем организма.

Выяснить больше – врач вывод из запоя

Нельзя игнорировать первые признаки серьёзного алкогольного отравления: промедление повышает риск судорожных припадков, остановки дыхания и комы. Нарколог на дом в Реутове рекомендован при следующих симптомах:

Подробнее – http://vyvod-iz-zapoya-reutov4.ru

Если узнаёте подобные признаки у себя или у родственника — не ждите кризиса. Чем быстрее обратиться за профессиональной поддержкой, тем легче вернуть здоровье и гармонию в семью.

Детальнее – https://lechenie-alkogolizma-korolev5.ru/lechenie-alkogolizma-anonimno-v-koroleve/

Наши специалисты регулярно проходят обучение и сертификацию по последним международным протоколам лечения алкогольной интоксикации. В арсенале «ЧелябДоктор» — передовое оборудование для инфузий, портативные насосы и тест-системы для контроля электролитов, глюкозы и функции печени прямо на дому.

Разобраться лучше – поставить капельницу от запоя на дому

Капельницы с растворами электролитов, витаминов, глюкозы и гепатопротекторов обеспечивают быстрое восстановление водно-солевого баланса, детоксикацию и поддержку печени. Инфузионное лечение позволяет нормализовать артериальное давление и сердечный ритм.

Подробнее можно узнать тут – вывод из запоя на дому круглосуточно ростов-на-дону

Для устойчивого отказа от вредных привычек применяется кодирование — метод, основанный на психологическом воздействии, а также заместительная терапия, при которой пациент получает контролируемые дозы препаратов, снижающих ломку и тягу.

Углубиться в тему – http://narkologicheskaya-klinika-mariupol13.ru

Метод лечения

Получить дополнительные сведения – наркологическая клиника ростов-на-дону

Запой — это длительный приступ непрерывного употребления алкоголя, когда человек теряет контроль над количеством выпиваемого, что приводит к серьёзному отравлению организма. Нарушение водно-солевого баланса, угнетение центральной нервной системы и риск сердечно-сосудистых осложнений требуют немедленного вмешательства. В Челябинске клиника «ЧелябМед» предлагает круглосуточную неотложную помощь на дому и в условиях стационара, гарантируя полную анонимность и комфорт пациенту.

Детальнее – вывод из запоя в челябинске

Медицинский вывод из запоя — это единственно правильное и безопасное решение. Врач-нарколог не только устранит симптомы отравления, но и грамотно скорректирует все жизненно важные параметры, предотвратит резкое падение давления, судорожный синдром, обеспечит защиту печени, почек и сердца.

Выяснить больше – vyvod iz zapoya

Чтобы вызвать нарколога на дом, достаточно позвонить по специализированным горячим телефонам или оформить заявку на сайте. Специалисты быстро реагируют на обращения, проводят первичную оценку и выезжают в течение часа. Важным аспектом является наличие лицензии и квалификации у медицинского персонала, что гарантирует безопасность и эффективность лечения.

Получить дополнительные сведения – помощь нарколога на дому

Домашний формат подходит при: длительном запое (более 48 часов), выраженной интоксикации без судорог и психотических симптомов, невозможности или нежелании пациента ехать в стационар, необходимости срочной психологической стабилизации. Также вызов на дом показан тем, кто желает анонимности и минимального вмешательства в рабочий и семейный график.

Узнать больше – http://narkolog-na-dom-rostov-na-donu13.ru/narkolog-na-dom-rostov/

Обращаясь в «ВолгаМед», вы получаете:

Разобраться лучше – лечение в наркологической клинике в волгограде

Наша миссия — помочь каждому человеку преодолеть алкогольную зависимость с минимальным дискомфортом и максимальной эффективностью. Мы исходим из следующих принципов:

Ознакомиться с деталями – http://narkologicheskaya-klinika-rostov13.ru

Затяжной запой опасен для жизни. Врачи наркологической клиники в Екатеринбурге проводят срочный вывод из запоя — на дому или в стационаре. Анонимно, безопасно, круглосуточно.

Изучить вопрос глубже – вывод из запоя свердловская область

Чтобы обеспечить безопасный и поэтапный выход из запоя, важно обратиться к специалистам, которые определят оптимальный курс лечения, учитывая индивидуальное состояние пациента. Наркологическая клиника «Код здоровья» в Архангельске предлагает круглосуточную помощь, обеспечивая как лечение на дому, так и в стационаре для пациентов с тяжёлыми формами интоксикации.

Детальнее – https://vyvod-iz-zapoya-arkhangelsk6.ru/vyvod-iz-zapoya-na-domu-arkhangelsk

Нарколог рекомендует кодирование при наличии следующих признаков:

Подробнее можно узнать тут – kodirovanie ot alkogolizma v pushkino

Мультидисциплинарная программа строится на взаимодействии нескольких специалистов — нарколога, психотерапевта, социального работника и, при необходимости, специалиста по физреабилитации. Такой формат позволяет:

Изучить вопрос глубже – http://www.domen.ru

Своевременный вызов специалиста особенно важен при следующих признаках:

Получить дополнительную информацию – вывод из запоя на дому мариуполь

Самостоятельно выйти из запоя — почти невозможно. В Екатеринбурге врачи клиники проводят медикаментозный вывод из запоя с круглосуточным выездом. Доверяйте профессионалам.

Детальнее – вывод из запоя на дому город екатеринбург

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Екатеринбурге приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Узнать больше – ekaterinburg

Своевременный выезд нарколога снижает риск осложнений и ускоряет вывод из запоя, а под контролем профессионала каждая процедура проходит максимально безопасно.

Узнать больше – vyvod iz zapoya reutov

Психотерапевтические программы включают индивидуальные и групповые занятия, направленные на восстановление психологического состояния и формирование мотивации к трезвому образу жизни. Важной частью терапии является работа с родственниками пациента, что способствует укреплению социальной поддержки. Информацию о современных методах психотерапии можно найти на сайте Российской психотерапевтической ассоциации.

Выяснить больше – https://narkologicheskaya-klinika-chelyabinsk13.ru/

Например, если речь идет о выводе из запоя, врач проведет тщательное обследование пациента, чтобы определить общее состояние здоровья и наличие возможных осложнений. На основе диагностики будет назначена инфузионная терапия, которая включает введение растворов, витаминов и препаратов для снятия абстиненции.

Подробнее можно узнать тут – вызвать нарколога на дом

После оформления заявки по телефону или на сайте оператор уточняет адрес и текущее состояние пациента. В критических ситуациях врач может прибыть в течение 60 минут, в стандартном режиме — за 1–2 часа. На месте проводится сбор анамнеза и оценка жизненных показателей: артериального давления, пульса, сатурации и температуры тела. Затем выбирается оптимальный протокол детоксикации — «мягкий» метод для постепенного выведения токсинов или экспресс-методика при острой интоксикации. Процедура капельного введения комбинированного раствора длится от двух до четырёх часов: специалист контролирует состояние пациента, корректирует дозировки и при необходимости вводит корригирующие препараты. По окончании врач оставляет детальный план поддерживающей терапии, включающий рекомендации по питанию, приёму сорбентов и витаминов, а также график повторных осмотров.

Получить дополнительные сведения – vyezd narkologa na dom

Когда организм на пределе, важна срочная помощь в Екатеринбурге — это команда опытных наркологов, которые помогут быстро и мягко выйти из запоя без вреда для здоровья.

Получить дополнительные сведения – вывод из запоя в стационаре в екатеринбурге

Срочный вызов нарколога необходим, если:

Подробнее тут – врач нарколог выезд на дом в иркутске

Вывод из запоя в Орехово-Зуево — это профессиональная экстренная помощь, предоставляемая наркологической клиникой «Гармония-Мед» на дому или в условиях современного стационара. Запой — тяжёлое состояние, при котором организм подвергается многодневному отравлению этанолом и продуктами его распада. Это критический момент в развитии алкогольной зависимости, опасный как для физического, так и для психического здоровья. Только своевременное и квалифицированное вмешательство позволяет предотвратить тяжёлые осложнения и вернуть пациента к полноценной жизни.

Получить дополнительную информацию – vyvod iz zapoya na domu cena

Наркологическая клиника «ЧелябДоктор» специализируется на экстренной и плановой детоксикации пациентов с алкогольной зависимостью. Наши главные преимущества:

Выяснить больше – выезд на дом капельница от запоя челябинск

Метод лечения

Изучить вопрос глубже – наркологическая клиника ростов-на-дону

Своевременное обращение к специалистам даёт возможность предотвратить тяжёлые последствия и обеспечить безопасный процесс восстановления. Ниже мы подробно рассмотрим каждый этап лечения.

Углубиться в тему – вывод из запоя вызов на дом архангельск

Используются препараты, нормализующие работу центральной нервной системы, корректирующие электролитный баланс и устраняющие симптомы алкогольной интоксикации. Применение седативных и противосудорожных средств снижает риск осложнений.

Подробнее тут – https://vyvod-iz-zapoya-rostov-na-donu13.ru/vyvod-iz-zapoya-na-donu

Если пациент находится в остром состоянии — начинается с детоксикации. Это не только капельницы для вывода токсинов и восстановления баланса в организме, но и поддержка работы сердца, печени, почек, купирование тревоги и бессонницы, снятие судорог, коррекция давления. Весь процесс проходит под наблюдением опытного нарколога, который учитывает хронические заболевания, особенности организма, степень интоксикации.

Исследовать вопрос подробнее – https://lechenie-alkogolizma-korolev5.ru/lechenie-alkogolizma-v-stacionare-v-koroleve

Медикаментозная детоксикация позволяет быстро и безопасно очистить организм от токсинов и продуктов распада алкоголя или наркотиков, минимизируя риски осложнений. Используются препараты, которые восстанавливают работу печени, почек и других органов, а также нормализуют электролитный баланс.

Подробнее тут – https://narkologicheskaya-klinika-mariupol13.ru

Сопутствующие патологии печени, почек, сердца или ЖКТ усугубляют последствия запоя. Без коррекции электролитного баланса и поддержки органов пациент рискует получить необратимые осложнения.

Получить дополнительную информацию – вывод из запоя дешево в челябинске

Затяжной запой опасен для жизни. Врачи наркологической клиники в Екатеринбурге проводят срочный вывод из запоя — на дому или в стационаре. Анонимно, безопасно, круглосуточно.

Подробнее – екатеринбург.

В «ВолгаМед» работают врачи-наркологи, психотерапевты и реабилитологи с опытом от 5 до 20 лет. Каждый специалист регулярно проходит повышение квалификации, участвует в научных конференциях и владеет современными методами диагностики и лечения зависимостей.

Исследовать вопрос подробнее – запой наркологическая клиника волгоград

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Изучить вопрос глубже – вывод из запоя в стационаре в екатеринбурге

Внутривенная инфузия – это один из самых быстрых и безопасных способов очистки организма от алкоголя и его токсичных продуктов распада. Она позволяет:

Получить дополнительную информацию – капельница от запоя на дому недорого красноярск

Чтобы вызвать нарколога на дом, достаточно позвонить по специализированным горячим телефонам или оформить заявку на сайте. Специалисты быстро реагируют на обращения, проводят первичную оценку и выезжают в течение часа. Важным аспектом является наличие лицензии и квалификации у медицинского персонала, что гарантирует безопасность и эффективность лечения.

Подробнее – вызвать врача нарколога на дом волгоград

Клиника «РостовМед» предлагает профессиональную наркологическую помощь в Ростове и области в режиме 24/7. Наша команда готова выехать на дом к пациенту в любое время суток, обеспечивая анонимность и высокие медицинские стандарты. В основе работы — индивидуальный подход, современное оборудование и чётко отлаженные протоколы детоксикации, что позволяет безопасно вывести пациента из запоя и начать этап реабилитации без стресса госпитализации.

Узнать больше – https://narkologicheskaya-klinika-rostov13.ru/

Когда организм на пределе, важна срочная помощь в Екатеринбурге — это команда опытных наркологов, которые помогут быстро и мягко выйти из запоя без вреда для здоровья.

Исследовать вопрос подробнее – вывод из запоя недорого в екатеринбурге

Для детоксикации используются современные препараты и методы введения, позволяющие быстро нейтрализовать токсическое воздействие:

Подробнее тут – лечение наркомании реабилитация в мариуполе

Своевременный вызов специалиста особенно важен при следующих признаках:

Получить больше информации – http://vyvod-iz-zapoya-mariupol13.ru

Своевременный выезд нарколога снижает риск осложнений и ускоряет вывод из запоя, а под контролем профессионала каждая процедура проходит максимально безопасно.

Получить дополнительную информацию – http://vyvod-iz-zapoya-reutov4.ru

Клиническая помощь на дому охватывает не только острые состояния, но и плановые мероприятия по выводу из запоя, устранению абстиненции и восстановлению водно-электролитного баланса. Используются только сертифицированные препараты, рекомендованные Минздравом России.

Исследовать вопрос подробнее – https://narcolog-na-dom-ekaterinburg55.ru/zapoj-narkolog-na-dom-v-ekaterinburge/

В клинике применяются комплексные программы, включающие медицинскую детоксикацию, психотерапевтическую поддержку и социальную реабилитацию. Медицинская детоксикация проводится с использованием современных препаратов и методик, что позволяет снизить тяжесть абстинентного синдрома и минимизировать риски для здоровья пациента. Подробнее о методах детоксикации можно узнать на официальном портале Министерства здравоохранения России.

Получить больше информации – платная наркологическая клиника в челябинске

Существуют определённые признаки, свидетельствующие о необходимости срочного обращения за профессиональной помощью:

Выяснить больше – https://vyvod-iz-zapoya-orekhovo-zuevo4.ru/vyvod-iz-zapoya-na-domu-v-orekhovo-zuevo

Чтобы обеспечить безопасный и поэтапный выход из запоя, важно обратиться к специалистам, которые определят оптимальный курс лечения, учитывая индивидуальное состояние пациента. Наркологическая клиника «Код здоровья» в Архангельске предлагает круглосуточную помощь, обеспечивая как лечение на дому, так и в стационаре для пациентов с тяжёлыми формами интоксикации.

Ознакомиться с деталями – вывод из запоя недорого в архангельске

В Екатеринбурге решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Ознакомиться с деталями – свердловская область

Домашний формат подходит при: длительном запое (более 48 часов), выраженной интоксикации без судорог и психотических симптомов, невозможности или нежелании пациента ехать в стационар, необходимости срочной психологической стабилизации. Также вызов на дом показан тем, кто желает анонимности и минимального вмешательства в рабочий и семейный график.

Детальнее – нарколог на дом клиника в ростове-на-дону

Наши специалисты регулярно проходят обучение и сертификацию по последним международным протоколам лечения алкогольной интоксикации. В арсенале «ЧелябДоктор» — передовое оборудование для инфузий, портативные насосы и тест-системы для контроля электролитов, глюкозы и функции печени прямо на дому.

Детальнее – вызвать капельницу от запоя челябинск

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Изучить вопрос глубже – екатеринбург.

Наркологическая клиника в Ростове-на-Дону предоставляет полный спектр услуг по диагностике, лечению и реабилитации пациентов с алкогольной и наркотической зависимостью. Применение современных медицинских протоколов и индивидуальный подход к каждому пациенту обеспечивают высокую эффективность терапии и снижение риска рецидивов.

Выяснить больше – вывод наркологическая клиника в ростове-на-дону

Нарколог рекомендует кодирование при наличии следующих признаков:

Детальнее – http://kodirovanie-ot-alkogolizma-pushkino4.ru/kodirovanie-ot-alkogolizma-na-domu-v-pushkino/https://kodirovanie-ot-alkogolizma-pushkino4.ru

Нельзя игнорировать первые признаки серьёзного алкогольного отравления: промедление повышает риск судорожных припадков, остановки дыхания и комы. Нарколог на дом в Реутове рекомендован при следующих симптомах:

Выяснить больше – vyvod iz zapoya vyzov

Используются препараты, нормализующие работу центральной нервной системы, корректирующие электролитный баланс и устраняющие симптомы алкогольной интоксикации. Применение седативных и противосудорожных средств снижает риск осложнений.

Подробнее можно узнать тут – https://vyvod-iz-zapoya-rostov-na-donu13.ru/vyvod-iz-zapoya-na-donu/

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Екатеринбурге приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Получить больше информации – вывод из запоя на дому город екатеринбург

Современная наркологическая клиника в Мариуполе ориентирована на комплексное и индивидуальное лечение алкогольной и наркотической зависимости, обеспечивая пациентам высококвалифицированную помощь с использованием доказанных медицинских протоколов и новейших технологий. Зависимость — это хроническое заболевание, требующее профессионального подхода, основанного на научных данных и многолетнем опыте специалистов.

Подробнее можно узнать тут – вывод наркологическая клиника в мариуполе

Пациенты могут воспринимать окружающих как врагов, отказываться от помощи. Стресс от изоляции дома усугубляет состояние без профессиональной поддержки.

Получить дополнительные сведения – вывод из запоя в стационаре в челябинске

Без медицинской помощи запой может перерасти в тяжёлую форму алкогольной интоксикации, вызывая серьёзные сбои в работе всех систем организма.

Углубиться в тему – вывод из запоя на дому цена архангельск

В клинике каждому пациенту уделяют особое внимание. Врачи знают: универсальных решений нет, за каждым случаем — своя история и свои причины. Первый контакт начинается с конфиденциальной консультации. Можно просто позвонить или написать онлайн — уже на этом этапе врач поможет оценить ситуацию, объяснит возможные этапы и даст рекомендации по подготовке к визиту.

Подробнее – лечение алкоголизма стоимость

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Разобраться лучше – vyvod-iz-zapoya-ekaterinburg11.ru

При необходимости подключаются портативные кардиомониторы и пульсоксиметры, чтобы исключить риски кардиореспираторных осложнений в период детоксикации.

Получить больше информации – центр анонимного лечения наркомании

Существуют определённые признаки, свидетельствующие о необходимости срочного обращения за профессиональной помощью:

Подробнее тут – http://vyvod-iz-zapoya-orekhovo-zuevo4.ru

Клиника специализируется на домашней детоксикации и стационарном лечении алкогольной зависимости. Основные направления работы:

Детальнее – http://vyvod-iz-zapoya-mariupol13.ru

Нарколог прибывает в назначенное время, проводит замеры артериального давления, пульса, сатурации кислорода и температуры. Выполняется экспресс-анализ на содержание алкоголя в крови и оценка водно-электролитного баланса.

Выяснить больше – наркологическая клиника цены ростов-на-дону

По вопросам оформления вызова можно ознакомиться с правилами на портале Федеральной службы по надзору в сфере здравоохранения, где опубликованы актуальные рекомендации и требования к медицинским организациям.

Углубиться в тему – вызов нарколога на дом

Клиника оснащена современным оборудованием для мониторинга состояния пациентов и проведения процедур с максимальной безопасностью. Врачебный состав состоит из опытных наркологов, психиатров и психологов, регулярно повышающих квалификацию и применяющих доказательные методы лечения. На портале Российской медицинской ассоциации наркологов можно ознакомиться с рекомендациями по стандартам оказания наркологической помощи.

Углубиться в тему – платная наркологическая клиника в челябинске

Этот информативный текст отличается привлекательным содержанием и актуальными данными. Мы предлагаем читателям взглянуть на привычные вещи под новым углом, предоставляя интересный и доступный материал. Получите удовольствие от чтения и расширьте кругозор!

Только факты! – https://hjtruckservice.dk/hello-world

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Екатеринбурге приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Детальнее – нарколог вывод из запоя в екатеринбурге

В этой статье вы найдете познавательную и занимательную информацию, которая поможет вам лучше понять мир вокруг. Мы собрали интересные данные, которые вдохновляют на размышления и побуждают к действиям. Открывайте новую информацию и получайте удовольствие от чтения!

Читать дальше – https://dttravel.in/discover-manalis-flavors-with-this-guide-to-the-top-10-traditional-dishes

Эта обзорная заметка содержит ключевые моменты и факты по актуальным вопросам. Она поможет читателям быстро ориентироваться в теме и узнать о самых важных аспектах сегодня. Получите краткий курс по современной информации и оставайтесь в курсе событий!

Ознакомиться с деталями – https://gef.bg.ac.rs/2018/06/25/only-the-best

В этой публикации мы предлагаем подробные объяснения по актуальным вопросам, чтобы помочь читателям глубже понять их. Четкость и структурированность материала сделают его удобным для усвоения и применения в повседневной жизни.

Обратитесь за информацией – https://changingbankstatements.com/credit-card-installments

Эта статья предлагает живое освещение актуальной темы с множеством интересных фактов. Мы рассмотрим ключевые моменты, которые делают данную тему важной и актуальной. Подготовьтесь к насыщенному путешествию по неизвестным аспектам и узнайте больше о значимых событиях.

Секреты успеха внутри – https://mandysbeautysupply.com/getting-wiggy-with-it

В этой публикации мы предлагаем подробные объяснения по актуальным вопросам, чтобы помочь читателям глубже понять их. Четкость и структурированность материала сделают его удобным для усвоения и применения в повседневной жизни.

Только факты! – https://thevanescape.com/things-to-do-in-farmington-new-mexico

Эта публикация завернет вас в вихрь увлекательного контента, сбрасывая стереотипы и открывая двери к новым идеям. Каждый абзац станет для вас открытием, полным ярких примеров и впечатляющих достижений. Подготовьтесь быть вовлеченными и удивленными каждый раз, когда продолжите читать.

Секреты успеха внутри – https://safetytambang.com/keselamatan-kerja-di-kantor

Эта информационная заметка содержит увлекательные сведения, которые могут вас удивить! Мы собрали интересные факты, которые сделают вашу жизнь ярче и полнее. Узнайте нечто новое о привычных аспектах повседневности и откройте для себя удивительный мир информации.

Ознакомьтесь с аналитикой – http://www.enirys.fr/galerie/img_0719

Этот текст призван помочь читателю расширить кругозор и получить практические знания. Мы используем простой язык, наглядные примеры и структурированное изложение, чтобы сделать обучение максимально эффективным и увлекательным.

Открыть полностью – https://continental-food.co.uk/roasted-tomato-soup

Предлагаем вашему вниманию интересную справочную статью, в которой собраны ключевые моменты и нюансы по актуальным вопросам. Эта информация будет полезна как для профессионалов, так и для тех, кто только начинает изучать тему. Узнайте ответы на важные вопросы и расширьте свои знания!

Изучить аспект более тщательно – https://jp-art.photography/portfolios/rocky-island

Публикация приглашает вас исследовать неизведанное — от древних тайн до современных достижений науки. Вы узнаете, как случайные находки превращались в революции, а смелые мысли — в новые эры человеческого прогресса.

Ознакомьтесь с аналитикой – https://redcrosstrainingcentre.org/2013/10/04/a-look-inside-the-protein-bar

Этот информационный обзор станет отличным путеводителем по актуальным темам, объединяющим важные факты и мнения экспертов. Мы исследуем ключевые идеи и представляем их в доступной форме для более глубокого понимания. Читайте, чтобы оставаться в курсе событий!

Более того — здесь – https://www.tenutacappellina.com/it/tenuta-cappellina-at-the-vinexpo-hong-kong

Этот информативный текст отличается привлекательным содержанием и актуальными данными. Мы предлагаем читателям взглянуть на привычные вещи под новым углом, предоставляя интересный и доступный материал. Получите удовольствие от чтения и расширьте кругозор!

Погрузиться в научную дискуссию – https://pennyirvinemassagetherapy.co.uk/hip-operation-my-recovery-im-now-6-weeks-post-op

Этот информативный текст выделяется своими захватывающими аспектами, которые делают сложные темы доступными и понятными. Мы стремимся предложить читателям глубину знаний вместе с разнообразием интересных фактов. Откройте новые горизонты и развивайте свои способности познавать мир!

Все материалы собраны здесь – https://crossoceantravel.com/nature-holiday-quotes

Эта информационная заметка содержит увлекательные сведения, которые могут вас удивить! Мы собрали интересные факты, которые сделают вашу жизнь ярче и полнее. Узнайте нечто новое о привычных аспектах повседневности и откройте для себя удивительный мир информации.

Разобраться лучше – http://interiordesignerwebgngj.cf/post/34

Эта статья предлагает живое освещение актуальной темы с множеством интересных фактов. Мы рассмотрим ключевые моменты, которые делают данную тему важной и актуальной. Подготовьтесь к насыщенному путешествию по неизвестным аспектам и узнайте больше о значимых событиях.

Нажми и узнай всё – https://www.sofiesworld.be/cropped-logo-sofiesworld-1-png

Эта статья предлагает живое освещение актуальной темы с множеством интересных фактов. Мы рассмотрим ключевые моменты, которые делают данную тему важной и актуальной. Подготовьтесь к насыщенному путешествию по неизвестным аспектам и узнайте больше о значимых событиях.

Расширить кругозор по теме – https://alunoslamaalanwallace.net.br/carvao-ou-luz-do-sol

Этот информативный текст выделяется своими захватывающими аспектами, которые делают сложные темы доступными и понятными. Мы стремимся предложить читателям глубину знаний вместе с разнообразием интересных фактов. Откройте новые горизонты и развивайте свои способности познавать мир!

Посмотреть подробности – https://www.zakcpa.com/building-2

Мы предлагаем вам подробное руководство, основанное на проверенных источниках и реальных примерах. Каждая часть публикации направлена на то, чтобы помочь вам разобраться в сложных вопросах и применить знания на практике.

Неизвестные факты о… – https://www.zakcpa.com/building-2

В этой статье-обзоре мы соберем актуальную информацию и интересные факты, которые освещают важные темы. Читатели смогут ознакомиться с различными мнениями и подходами, что позволит им расширить кругозор и глубже понять обсуждаемые вопросы.

Получить дополнительную информацию – https://shiftingwaalepackersandmovers.com/we-introduce-new-boat-and-flight-service

Эта статья предлагает уникальную подборку занимательных фактов и необычных историй, которые вы, возможно, не знали. Мы постараемся вдохновить ваше воображение и разнообразить ваш кругозор, погружая вас в мир, полный интересных открытий. Читайте и открывайте для себя новое!

Подробнее тут – https://suamaynangluonghcm.net/sua-chua-nang-luong-mat-troi-tai-quan-9

Нужна срочная помощь при алкогольном отравлении или запое? Вызовите нарколога на дом в Иркутске! Квалифицированная помощь нарколога на дому: диагностика, капельница, стабилизация состояния. Круглосуточный выезд нарколога, анонимность и снижение рисков – с «ТрезвоМед». Самостоятельный отказ невозможен? Необходима наркологическая помощь. Васильев: «Не затягивайте с помощью при алкогольном отравлении!».

Детальнее – https://narcolog-na-dom-v-irkutske0.ru/vyzov-narkologa-na-dom-irkutsk

Особую опасность представляет белая горячка (алкогольный психоз). У пациента возникают галлюцинации, приступы паники, агрессивное поведение, дезориентация во времени и пространстве. Это состояние требует незамедлительного вмешательства врача, так как человек может представлять опасность для себя и окружающих.

Получить дополнительные сведения – врач нарколог на дом новокузнецк.

После поступления звонка специалисты нашей клиники оперативно выезжают по адресу пациента в Новосибирске. Врач начинает работу с детальной диагностики: измеряет пульс, артериальное давление, сатурацию (уровень кислорода в крови), оценивает состояние нервной и сердечно-сосудистой систем, уточняет наличие хронических заболеваний, аллергических реакций, длительность и тяжесть запоя.

Ознакомиться с деталями – вывод из запоя на дому новосибирск.

В таких случаях своевременный вызов нарколога на дом позволяет быстро стабилизировать состояние больного и предотвратить тяжелые последствия.

Получить дополнительные сведения – нарколог на дом вывод новосибирск

Введение препаратов осуществляется внутривенно, что обеспечивает оперативное действие медикаментов. В состав лечебного раствора входят средства для детоксикации организма, нормализации водно-электролитного и кислотно-щелочного баланса. При необходимости врач дополнительно вводит препараты, защищающие печень, стабилизирующие работу сердца и успокаивающие нервную систему. Вся процедура проводится под строгим контролем нарколога, который следит за состоянием пациента и корректирует терапию при необходимости. По завершении процедуры врач дает пациенту и его родственникам подробные рекомендации по дальнейшему восстановлению и профилактике повторных запоев.

Подробнее тут – http://kapelnica-ot-zapoya-nizhniy-novgorod0.ru/kapelnicza-ot-zapoya-czena-nizhnij-novgorod/

Алкогольный запой представляет собой опасное состояние, когда организм не способен самостоятельно справиться с токсической нагрузкой, вызванной длительным употреблением спиртного. Если запой продолжается более двух-трёх дней, у пациента могут появляться симптомы сильной рвоты, головокружения, спутанности сознания, судорог, резких колебаний артериального давления, а также выраженный абстинентный синдром с паническими атаками и бессонницей. При таких показаниях оперативное вмешательство становится жизненно необходимым для предотвращения серьезных осложнений и ускорения процесса восстановления.

Подробнее можно узнать тут – капельница от запоя на дому цена нижний новгород

Ниже приведена ориентировочная таблица с ценами на основные виды услуг, предоставляемых нашей клиникой. Окончательная стоимость определяется после первичного осмотра и индивидуально согласовывается с пациентом:

Исследовать вопрос подробнее – postavit-kapelniczu-ot-zapoya nizhnij novgorod

В таких случаях своевременное обращение за помощью позволяет быстро стабилизировать состояние и предотвратить развитие серьезных осложнений.

Подробнее можно узнать тут – врач нарколог на дом

Наркологическая клиника «АнтиДот» предлагает срочный вызов нарколога на дом в Воронеже и Воронежской области. Наша служба экстренной наркологической помощи доступна круглосуточно и позволяет быстро справиться с тяжелыми состояниями, вызванными алкогольной и наркотической зависимостью. Опытные врачи проведут детоксикацию организма, помогут снять абстинентный синдром и стабилизировать общее состояние пациента в комфортных домашних условиях.

Получить больше информации – http://narcolog-na-dom-voronezh00.ru

Современные методы лечения при выводе из запоя включают как медикаментозную детоксикацию, так и психологическую реабилитацию. В Уфе наркологи используют капельничное введение лекарственных средств, которые помогают быстро вывести токсины, нормализовать обмен веществ и стабилизировать работу внутренних органов. Одновременно с этим проводится психологическая поддержка для снижения эмоционального стресса, связанного с запоем.

Детальнее – нарколог на дом уфа

Специалист выясняет продолжительность запоя, характер симптомов и наличие сопутствующих заболеваний. Полученные данные являются основой для составления индивидуальной программы терапии и выбора оптимальных медикаментов.

Узнать больше – http://narcolog-na-dom-ufa00.ru

Лечение зависимости требует не только физической детоксикации, но и работы с психоэмоциональным состоянием пациента. Психотерапевтическая поддержка помогает выявить глубинные причины зависимости, снизить уровень стресса и сформировать устойчивые навыки самоконтроля, что существенно снижает риск рецидивов.

Подробнее тут – http://narcolog-na-dom-ufa000.ru

Процесс вывода из запоя капельничным методом организован по строгой схеме, позволяющей обеспечить максимальную эффективность терапии. Каждая стадия направлена на комплексное восстановление организма и минимизацию риска осложнений.

Получить дополнительную информацию – https://kapelnica-ot-zapoya-tyumen0.ru/kapelnicza-ot-zapoya-na-domu-tyumen/

Затяжной запой опасен для жизни. Врачи наркологической клиники в Екатеринбурге проводят срочный вывод из запоя — на дому или в стационаре. Анонимно, безопасно, круглосуточно.

Изучить вопрос глубже – вывод из запоя в екатеринбурге

Есть ситуации, когда вызов врача на дом становится не просто желателен, а жизненно необходим. Если зависимый человек не способен самостоятельно прекратить употребление алкоголя или наркотиков, а его самочувствие заметно ухудшается, необходимо незамедлительно обратиться за медицинской помощью. Поводом для вызова нарколога служат следующие опасные симптомы:

Подробнее можно узнать тут – вызвать нарколога на дом

This is really interesting, You’re a very skilled blogger. I’ve joined your feed and look forward to seeking more of your magnificent post. Also, I’ve shared your site in my social networks!

Далее начинается этап детоксикации — это основа безопасного и эффективного вывода из запоя. Используются капельницы с современными очищающими и поддерживающими препаратами, комплекс витаминов, препараты для поддержки печени, почек и сердечно-сосудистой системы. При необходимости назначаются средства для стабилизации психоэмоционального состояния, купирования судорог, нормализации сна и снижения тревожности.

Углубиться в тему – https://vyvod-iz-zapoya-balashiha5.ru/

Попытки “перетерпеть” запой или самолечение часто заканчиваются тяжёлыми осложнениями, включая инсульты, инфаркты, алкогольные психозы. Чем быстрее начнётся профессиональная помощь, тем выше шансы избежать опасных последствий.

Узнать больше – http://vyvod-iz-zapoya-himki5.ru

В клинике «Решение+» предусмотрены оба основных формата: выезд на дом и лечение в стационаре. Домашний вариант подойдёт тем, чьё состояние относительно стабильно, нет риска тяжёлых осложнений. Врач приезжает с полным комплектом оборудования и медикаментов, проводит капельницу на дому и даёт инструкции по дальнейшему уходу.

Разобраться лучше – срочный вывод из запоя ногинск

В зависимости от тяжести состояния подбирается индивидуальная программа детоксикации. В неё входят: — Инфузионная терапия (капельницы) для очищения организма от токсинов; — Поддерживающие препараты для работы сердца, печени, нервной системы; — Симптоматическое лечение (устранение рвоты, судорог, бессонницы); — Витамины и средства для восстановления водно-солевого баланса.

Детальнее – http://www.domen.ru

Самостоятельно выйти из запоя — почти невозможно. В Екатеринбурге врачи клиники проводят медикаментозный вывод из запоя с круглосуточным выездом. Доверяйте профессионалам.

Подробнее – вывод из запоя на дому цена

Запой может быть не только физически тяжёлым, но и психологически разрушительным. Поэтому важно вовремя обратиться за помощью. Вывод из запоя в Нижнем Новгороде — это необходимая медицинская процедура, которая помогает победить алкогольную зависимость и восстановить здоровье. Мы в клинике «АнтиЗависимость» предлагаем круглосуточную помощь в комфортных условиях — на дому или в стационаре.

Подробнее тут – narkolog-na-dom novokuznetsk

Запой – это серьезная проблема, когда организм перестает работать без постоянного поступления алкоголя. Из-за запоя токсины отравляют организм, нарушая работу органов и снижая иммунитет. Попытки самостоятельно бросить пить во время запоя могут привести к ухудшению самочувствия. «Семья и Здоровье» лечит запой на дому – это удобно и снижает стресс. Мы приедем в любое время суток и проведем все процедуры для восстановления здоровья. Длительное пьянство может привести к опасным для жизни осложнениям. Нельзя затягивать с лечением запоя, это может привести к серьезным последствиям.

Получить больше информации – нарколог на дом вывод из запоя красноярск

В Екатеринбурге решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Детальнее – срочный вывод из запоя

После поступления звонка специалисты нашей клиники оперативно выезжают по адресу пациента в Новосибирске. Врач начинает работу с детальной диагностики: измеряет пульс, артериальное давление, сатурацию (уровень кислорода в крови), оценивает состояние нервной и сердечно-сосудистой систем, уточняет наличие хронических заболеваний, аллергических реакций, длительность и тяжесть запоя.

Подробнее – vyvod-iz-zapoya-klinika novosibirsk

Алкогольный запой представляет собой тяжелое состояние, вызванное длительным бесконтрольным употреблением спиртных напитков. Без медицинского вмешательства вывести организм из запоя может быть сложно и даже опасно. Срочная помощь нарколога требуется при следующих признаках:

Углубиться в тему – капельница от запоя анонимно нижний новгород

Действие и назначение

Получить дополнительные сведения – http://vyvod-iz-zapoya-novosibirsk00.ru

Наши специалисты используют проверенные и сертифицированные медикаменты, которые подбираются индивидуально для каждого пациента:

Ознакомиться с деталями – капельница от запоя на дому нижний новгород.

Наркологическая клиника «МедЛайн» предоставляет профессиональные услуги врача-нарколога с выездом на дом в Новосибирске и Новосибирской области. Мы оперативно помогаем пациентам справиться с тяжелыми состояниями при алкогольной и наркотической зависимости. Экстренный выезд наших специалистов доступен круглосуточно, а лечение проводится с применением проверенных методик и препаратов, что гарантирует безопасность и конфиденциальность каждому пациенту.

Получить дополнительную информацию – http://www.domen.ru

При обращении в клинику «НаркоНет» пациенту предоставляется полный спектр мероприятий, направленных на восстановление организма после запоя. Сначала наш специалист приезжает на дом в течение 30–60 минут после вызова. На месте проводится детальный осмотр: измеряются основные жизненные показатели (давление, пульс, уровень кислорода в крови), собирается подробный анамнез и оценивается степень интоксикации. Полученные данные позволяют врачу разработать индивидуальный план лечения.

Получить дополнительную информацию – вызвать капельницу от запоя на дому в нижний новгороде

Обращение за помощью на дому имеет ряд значительных преимуществ, которые делают данный метод лечения предпочтительным для многих пациентов:

Разобраться лучше – [url=https://narcolog-na-dom-ufa0.ru/]нарколог на дом уфа[/url]

Лечение зависимости требует не только физической детоксикации, но и работы с психоэмоциональным состоянием пациента. Психотерапевтическая поддержка помогает выявить глубинные причины зависимости, снизить уровень стресса и сформировать устойчивые навыки самоконтроля, что существенно снижает риск рецидивов.

Получить больше информации – нарколог на дом недорого уфа

Алкогольная и наркотическая зависимости могут привести к тяжелым и опасным для жизни состояниям. Вызов нарколога становится необходимым, если:

Подробнее – нарколог на дом воронеж.

Почему пациенты выбирают именно нас:

Изучить вопрос глубже – http://narkologicheskaya-pomoshch-lyubercy5.ru/platnaya-narkologicheskaya-pomoshch-v-lyubercah/

Когда запой приводит к критическому ухудшению состояния, оперативное лечение становится жизненно необходимым. В Тюмени доступна услуга капельничного вывода из запоя на дому, которая позволяет начать детоксикацию организма незамедлительно и в комфортной для пациента обстановке. Такой формат терапии помогает не только вывести токсины, но и значительно снизить риск осложнений, сохраняя при этом полную конфиденциальность.

Разобраться лучше – http://kapelnica-ot-zapoya-tyumen0.ru/kapelnicza-ot-zapoya-na-domu-czena-tyumen/

Специалист выясняет продолжительность запоя, характер симптомов и наличие сопутствующих заболеваний. Полученные данные являются основой для составления индивидуальной программы терапии и выбора оптимальных медикаментов.

Выяснить больше – нарколог на дом стоимость в уфе

Кодирование — это не просто медицинская манипуляция, а серьёзный шаг к восстановлению контроля над собственной жизнью и формированию устойчивой ремиссии.

Исследовать вопрос подробнее – https://kodirovanie-ot-alkogolizma-mytishchi5.ru/centr-kodirovaniya-ot-alkogolizma-v-mytishchah

Многодневные алкогольные запои опасны не только для здоровья, но и для жизни. В этот период организм подвергается тяжелейшей интоксикации, страдают сердце, печень, нервная система, а психоэмоциональное состояние может выйти из-под контроля. Самостоятельно выйти из запоя очень трудно и опасно: любое промедление или попытка “перетерпеть” чреваты судорогами, галлюцинациями, инфарктом, тяжелой депрессией или делирием. Именно поэтому своевременное обращение к профессионалам — залог не только скорого, но и безопасного восстановления. В наркологической клинике «НаркоМедцентр» в Балашихе организован современный и медицински обоснованный вывод из запоя: здесь пациентов ждет индивидуальный подход, круглосуточное медицинское наблюдение и полная конфиденциальность.

Детальнее – вывод из запоя в стационаре

После поступления звонка нарколог оперативно выезжает по указанному адресу и прибывает в течение 30–60 минут. Врач незамедлительно приступает к оказанию помощи по четко отработанному алгоритму, состоящему из следующих этапов:

Получить дополнительную информацию – врач нарколог на дом

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Получить дополнительную информацию – в екатеринбурге

На основании проведенных обследований врач разрабатывает индивидуальную терапевтическую схему. Основной этап — детоксикация организма при помощи внутривенных инфузий. В капельницу включают растворы для восстановления водно-солевого баланса, выведения токсинов и улучшения работы внутренних органов. Также по показаниям назначают препараты для поддержки работы печени и сердца, стабилизации психоэмоционального состояния и снятия симптомов абстиненции. На протяжении процедуры врач ведет постоянный контроль за состоянием пациента, корректируя лечение при необходимости.

Получить дополнительную информацию – http://vyvod-iz-zapoya-novosibirsk0.ru/vyvod-iz-zapoya-czena-novosibirsk/

Врачи клиники «ВитаЛайн» для снятия интоксикации и облегчения состояния пациента применяют исключительно качественные и проверенные лекарственные препараты, подбирая их в зависимости от особенностей ситуации и состояния здоровья пациента:

Получить дополнительные сведения – нарколог на дом вывод из запоя в новосибирске

В Екатеринбурге решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Изучить вопрос глубже – http://vyvod-iz-zapoya-ekaterinburg11.ru

Введение препаратов осуществляется внутривенно, что обеспечивает оперативное действие медикаментов. В состав лечебного раствора входят средства для детоксикации организма, нормализации водно-электролитного и кислотно-щелочного баланса. При необходимости врач дополнительно вводит препараты, защищающие печень, стабилизирующие работу сердца и успокаивающие нервную систему. Вся процедура проводится под строгим контролем нарколога, который следит за состоянием пациента и корректирует терапию при необходимости. По завершении процедуры врач дает пациенту и его родственникам подробные рекомендации по дальнейшему восстановлению и профилактике повторных запоев.

Изучить вопрос глубже – https://kapelnica-ot-zapoya-nizhniy-novgorod0.ru/

Нужна срочная помощь при алкогольном отравлении или запое? Вызовите нарколога на дом в Иркутске! Квалифицированная помощь нарколога на дому: диагностика, капельница, стабилизация состояния. Круглосуточный выезд нарколога, анонимность и снижение рисков – с «ТрезвоМед». Самостоятельный отказ невозможен? Необходима наркологическая помощь. Васильев: «Не затягивайте с помощью при алкогольном отравлении!».

Детальнее – https://narcolog-na-dom-v-irkutske0.ru/

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Получить дополнительную информацию – вывод из запоя в стационаре

Обращение в клинику начинается с подробной консультации, где пациент или его родственники могут задать любые вопросы о методах лечения, продолжительности курса и возможностях реабилитации. Первый этап — диагностика: анализы, осмотр врача-нарколога, оценка общего состояния и выявление сопутствующих заболеваний.

Подробнее тут – наркологическая клиника клиника помощь

Близкий человек в запое? Не ждите ухудшения. Обратитесь в клинику — здесь проведут профессиональный вывод из запоя с последующим восстановлением организма.

Получить дополнительную информацию – вывод из запоя город екатеринбург

Обратившись к нам, вы получите анонимное и безопасное лечение, полностью соответствующее медицинским стандартам.

Выяснить больше – https://narcolog-na-dom-novokuznetsk00.ru/narkolog-na-dom-czena-novokuzneczk

Современные методы лечения при выводе из запоя включают как медикаментозную детоксикацию, так и психологическую реабилитацию. В Уфе наркологи используют капельничное введение лекарственных средств, которые помогают быстро вывести токсины, нормализовать обмен веществ и стабилизировать работу внутренних органов. Одновременно с этим проводится психологическая поддержка для снижения эмоционального стресса, связанного с запоем.

Получить дополнительные сведения – https://narcolog-na-dom-ufa0.ru/narkolog-na-dom-kruglosutochno-ufa

Стоимость услуг по установке капельницы определяется индивидуально и зависит от нескольких факторов. В первую очередь, цена обусловлена тяжестью состояния пациента: при более сильной интоксикации и выраженных симптомах абстинентного синдрома может потребоваться расширенная терапия. Кроме того, итоговая сумма зависит от продолжительности запоя, так как длительное употребление спиртного ведет к более серьезному накоплению токсинов, требующему дополнительных лечебных мероприятий.

Исследовать вопрос подробнее – капельница от запоя на дому цена нижний новгород

Пациенты выбирают нашу клинику для срочного вызова врача-нарколога благодаря следующим важным преимуществам:

Разобраться лучше – нарколог на дом срочно

Клиника «НаркологикПлюс» предоставляет квалифицированную помощь нарколога на дому в Воронеже. Если вы или ваши близкие столкнулись с последствиями длительного употребления алкоголя или наркотиков, наши специалисты готовы оперативно выехать и оказать экстренную помощь. Мы проводим детоксикацию организма, снимаем симптомы абстинентного синдрома и стабилизируем состояние пациента, обеспечивая высокий уровень безопасности, строгую анонимность и индивидуальный подход.

Углубиться в тему – нарколог на дом срочно в воронеже

Услуга “Нарколог на дом” в Уфе охватывает широкий спектр лечебных мероприятий, направленных как на устранение токсической нагрузки, так и на работу с психоэмоциональным состоянием пациента. Комплексная терапия включает в себя медикаментозную детоксикацию, корректировку обменных процессов, а также психотерапевтическую поддержку, что позволяет не только вывести пациента из состояния запоя, но и помочь ему справиться с наркотической зависимостью.

Углубиться в тему – вызов нарколога на дом уфа

В подобных случаях вывод из запоя в домашних условиях без врачебного контроля крайне опасен и может привести к тяжёлым последствиям. Лучше сразу вызвать нарколога или привезти пациента в клинику — это поможет избежать критических осложнений.

Исследовать вопрос подробнее – vyvod-iz-zapoya-s-vyezdom

Запой – это угрожающее здоровью состояние, при котором человек утрачивает контроль над употреблением алкоголя, что приводит к накоплению токсинов в организме и может вызвать серьезные осложнения. В Уфе, столице Республики Башкортостан, опытные наркологи предоставляют услугу вызова на дом, позволяющую оперативно начать детоксикацию и стабилизировать состояние пациента в комфортной, знакомой обстановке. Такой подход обеспечивает не только быстрый вывод из запоя, но и комплексную терапию, включающую медикаментозное лечение и психологическую поддержку.

Изучить вопрос глубже – http://narcolog-na-dom-ufa00.ru

При поступлении вызова специалисты клиники «АнтиАлко» выезжают на дом в течение 30–60 минут. По прибытии врач проводит комплексную диагностику: измеряет артериальное давление, пульс, уровень кислорода в крови и собирает анамнез, чтобы оценить степень интоксикации. На основе полученных данных формируется индивидуальный план лечения, который включает:

Подробнее можно узнать тут – http://

В клинике «Решение+» предусмотрены оба основных формата: выезд на дом и лечение в стационаре. Домашний вариант подойдёт тем, чьё состояние относительно стабильно, нет риска тяжёлых осложнений. Врач приезжает с полным комплектом оборудования и медикаментов, проводит капельницу на дому и даёт инструкции по дальнейшему уходу.

Разобраться лучше – вывод из запоя на дому

После поступления звонка специалисты нашей клиники оперативно выезжают по адресу пациента в Новосибирске. Врач начинает работу с детальной диагностики: измеряет пульс, артериальное давление, сатурацию (уровень кислорода в крови), оценивает состояние нервной и сердечно-сосудистой систем, уточняет наличие хронических заболеваний, аллергических реакций, длительность и тяжесть запоя.

Изучить вопрос глубже – http://vyvod-iz-zapoya-novosibirsk0.ru

Процесс вывода из запоя капельничным методом организован по строгой схеме, позволяющей обеспечить максимальную эффективность терапии. Каждая стадия направлена на комплексное восстановление организма и минимизацию риска осложнений.

Получить дополнительную информацию – капельница от запоя на дому тюмень

Запой — состояние, при котором человек теряет контроль над количеством употребляемого алкоголя и уже не может самостоятельно прекратить пить. Подобные эпизоды представляют серьёзную угрозу для здоровья, а порой и для жизни. Особенно опасен резкий отказ от спиртного после длительных запоев — это может вызвать тяжёлые абстинентные расстройства, нарушение работы сердца, печени, нервной системы, галлюцинации и даже приступы судорог. В такой ситуации необходимо срочно обращаться к профессионалам. В наркологической клинике «Спасение Плюс» в Химках вывод из запоя осуществляется с выездом врача, гарантией безопасности и индивидуальным подходом.

Выяснить больше – вывод из запоя круглосуточно

В Екатеринбурге решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Подробнее тут – vyvod-iz-zapoya-czena ekaterinburg

Введение препаратов осуществляется внутривенно, что обеспечивает оперативное действие медикаментов. В состав лечебного раствора входят средства для детоксикации организма, нормализации водно-электролитного и кислотно-щелочного баланса. При необходимости врач дополнительно вводит препараты, защищающие печень, стабилизирующие работу сердца и успокаивающие нервную систему. Вся процедура проводится под строгим контролем нарколога, который следит за состоянием пациента и корректирует терапию при необходимости. По завершении процедуры врач дает пациенту и его родственникам подробные рекомендации по дальнейшему восстановлению и профилактике повторных запоев.

Детальнее – http://kapelnica-ot-zapoya-nizhniy-novgorod0.ru/kapelnicza-ot-zapoya-na-domu-nizhnij-novgorod/

Каждый день запоя увеличивает риск для жизни. Не рискуйте — специалисты в Екатеринбурге приедут на дом и окажут экстренную помощь. Без боли, стресса и ожидания.

Углубиться в тему – екатеринбург.

В период восстановления пациент получает психологическую поддержку, работает с психотерапевтом, осваивает навыки самоконтроля, учится противостоять стрессу без возвращения к прежним привычкам. После выписки возможно амбулаторное сопровождение, дистанционные консультации и поддержка для всей семьи.

Выяснить больше – https://narkologicheskaya-klinika-balashiha5.ru/platnaya-narkologicheskaya-klinika-v-balashihe

После звонка специалист клиники «ВитаЛайн» оперативно отправляется по указанному адресу и обычно прибывает в течение 30–60 минут. На месте врач сразу проводит детальную диагностику, оценивая состояние пациента: проверяет пульс, давление, сатурацию, степень интоксикации и наличие хронических болезней. На основании результатов осмотра нарколог разрабатывает индивидуальную схему терапии.

Углубиться в тему – http://narcolog-na-dom-novosibirsk0.ru/narkolog-na-dom-kruglosutochno-novosibirsk/

Современные методы лечения при выводе из запоя включают как медикаментозную детоксикацию, так и психологическую реабилитацию. В Уфе наркологи используют капельничное введение лекарственных средств, которые помогают быстро вывести токсины, нормализовать обмен веществ и стабилизировать работу внутренних органов. Одновременно с этим проводится психологическая поддержка для снижения эмоционального стресса, связанного с запоем.

Подробнее можно узнать тут – http://narcolog-na-dom-ufa0.ru

По окончании курса детоксикации нарколог дает пациенту и его близким подробные рекомендации, помогающие быстрее восстановить здоровье и предотвратить повторные случаи запоев.

Исследовать вопрос подробнее – https://vyvod-iz-zapoya-novosibirsk0.ru/vyvod-iz-zapoya-czena-novosibirsk/

Почему пациенты выбирают именно нас:

Подробнее можно узнать тут – skoraya-narkologicheskaya-pomoshch

После поступления звонка нарколог оперативно выезжает по указанному адресу и прибывает в течение 30–60 минут. Врач незамедлительно приступает к оказанию помощи по четко отработанному алгоритму, состоящему из следующих этапов:

Изучить вопрос глубже – вызвать нарколога на дом в воронеже

Стоимость услуг по установке капельницы определяется индивидуально и зависит от нескольких факторов. В первую очередь, цена обусловлена тяжестью состояния пациента: при более сильной интоксикации и выраженных симптомах абстинентного синдрома может потребоваться расширенная терапия. Кроме того, итоговая сумма зависит от продолжительности запоя, так как длительное употребление спиртного ведет к более серьезному накоплению токсинов, требующему дополнительных лечебных мероприятий.

Подробнее можно узнать тут – https://kapelnica-ot-zapoya-nizhniy-novgorod000.ru/kapelnicza-ot-zapoya-na-domu-nizhnij-novgorod

Пациенты выбирают нашу клинику для срочного вызова врача-нарколога благодаря следующим важным преимуществам:

Выяснить больше – вызов нарколога на дом новосибирск

Самостоятельно выйти из запоя — почти невозможно. В Екатеринбурге врачи клиники проводят медикаментозный вывод из запоя с круглосуточным выездом. Доверяйте профессионалам.

Разобраться лучше – вывод из запоя на дому

Каждый пациент в «НаркоМедцентре» в Балашихе с самого начала окружён вниманием и заботой. Сразу после обращения по телефону или через сайт медицинский персонал консультирует родственников, уточняет детали состояния, даёт рекомендации по первой помощи и при необходимости отправляет бригаду наркологов на дом. В случае тяжёлых абстинентных проявлений возможно экстренное транспортирование пациента в стационар.

Детальнее – быстрый вывод из запоя

После вашего звонка нарколог выезжает на дом в течение 30–60 минут. Прибыв на место, специалист проводит всесторонний медицинский осмотр, включая измерение артериального давления, пульса и уровня кислорода в крови, а также собирает анамнез для определения степени интоксикации.

Детальнее – запой нарколог на дом в воронеже

Запой – это неконтролируемое употребление алкоголя, которое приводит к серьезным последствиям. Алкогольное отравление организма приводит к серьезным проблемам со здоровьем. Выходить из запоя самостоятельно – рискованно и неэффективно. Мы предлагаем помощь при запое на дому, в привычных для вас условиях. Круглосуточная помощь при запое с выездом на дом за 30-60 минут. Длительный запой разрушает организм и может быть смертельным. Чем раньше вы обратитесь за помощью, тем больше шансов на выздоровление.

Изучить вопрос глубже – вывод из запоя дешево красноярск

В зависимости от тяжести состояния подбирается индивидуальная программа детоксикации. В неё входят: — Инфузионная терапия (капельницы) для очищения организма от токсинов; — Поддерживающие препараты для работы сердца, печени, нервной системы; — Симптоматическое лечение (устранение рвоты, судорог, бессонницы); — Витамины и средства для восстановления водно-солевого баланса.

Подробнее – https://narkologicheskaya-klinika-podolsk5.ru/chastnaya-narkologicheskaya-klinika-v-podolske/

— Медикаментозное кодирование: это введение специальных препаратов (инъекции, вшивание капсул, внутривенная или внутримышечная постановка), которые вызывают устойчивую непереносимость алкоголя. Даже небольшое количество спиртного вызывает сильнейшее отвращение и негативную реакцию организма, что исключает возможность употребления;

Подробнее – https://kodirovanie-ot-alkogolizma-mytishchi5.ru/narkolog-kodirovanie-ot-alkogolizma-v-mytishchah/

Запой может быть не только физически тяжёлым, но и психологически разрушительным. Поэтому важно вовремя обратиться за помощью. Вывод из запоя в Нижнем Новгороде — это необходимая медицинская процедура, которая помогает победить алкогольную зависимость и восстановить здоровье. Мы в клинике «АнтиЗависимость» предлагаем круглосуточную помощь в комфортных условиях — на дому или в стационаре.

Выяснить больше – https://narcolog-na-dom-novokuznetsk0.ru/

Экстренное вмешательство необходимо, когда самостоятельное прекращение употребления алкоголя или наркотиков становится невозможным, а состояние пациента ухудшается. Основные показания включают:

Выяснить больше – вызов нарколога цена в уфе

Специалист выясняет продолжительность запоя, характер симптомов и наличие сопутствующих заболеваний. Полученные данные являются основой для составления индивидуальной программы терапии и выбора оптимальных медикаментов.

Узнать больше – вызов нарколога на дом цена в уфе

Запой сопровождается быстрым накоплением токсинов, что может привести к нарушению работы сердца, печени и почек. Использование капельничного метода позволяет оперативно ввести современные препараты для детоксикации, что способствует быстрому восстановлению обменных процессов и нормализации работы внутренних органов. Оперативное лечение на дому особенно актуально, когда каждая минута имеет значение для спасения здоровья.

Изучить вопрос глубже – https://kapelnica-ot-zapoya-tyumen0.ru/postavit-kapelniczu-ot-zapoya-tyumen

Клиника «ТоксинНет» предлагает профессиональную помощь при алкогольной зависимости и запоях в Нижнем Новгороде. Наши опытные наркологи круглосуточно выезжают на дом для оказания экстренной медицинской помощи. Основным методом лечения является капельница от запоя, которая позволяет оперативно снять интоксикацию и стабилизировать общее состояние пациента. Мы обеспечиваем конфиденциальность, индивидуальный подход и высокий уровень безопасности процедур.

Разобраться лучше – капельница от запоя цена нижний новгород

Запой становится критическим, когда организм не справляется с постоянным поступлением алкоголя и начинает накапливать токсины. Если состояние пациента ухудшается, появляются такие симптомы, как сильная рвота, головокружение, спутанность сознания, судороги, резкие колебания артериального давления, а также проявления тяжелого абстинентного синдрома (дрожь, панические атаки, бессонница, тревожность), вызов нарколога становится необходимым. Также экстренная помощь требуется при наличии психических нарушений — галлюцинациях, агрессивном поведении или алкогольном психозе. Своевременное вмешательство позволяет стабилизировать состояние, предотвратить развитие осложнений и снизить риск для жизни.

Получить дополнительную информацию – http://vyvod-iz-zapoya-novosibirsk00.ru/

В этой публикации мы предлагаем подробные объяснения по актуальным вопросам, чтобы помочь читателям глубже понять их. Четкость и структурированность материала сделают его удобным для усвоения и применения в повседневной жизни.

Как достичь результата? – https://majesticglobaltourism.com/hello-world

Самостоятельно выйти из запоя — почти невозможно. В Екатеринбурге врачи клиники проводят медикаментозный вывод из запоя с круглосуточным выездом. Доверяйте профессионалам.

Выяснить больше – вывод из запоя на дому город екатеринбург

Распознать необходимость лечения просто: достаточно внимательно отнестись к тревожным признакам. Вот лишь некоторые ситуации, когда обращение в наркологическую клинику становится жизненно важным:

Подробнее тут – http://narkologicheskaya-klinika-balashiha5.ru/chastnaya-narkologicheskaya-klinika-v-balashihe/

В Екатеринбурге решение есть — наркологическая клиника. Здесь помогают людям выйти из запоя без страха и осуждения. Всё анонимно, грамотно и с заботой о каждом пациенте.

Разобраться лучше – вывод из запоя в екатеринбурге

Обращение за помощью на дому имеет ряд значительных преимуществ, которые делают данный метод лечения предпочтительным для многих пациентов:

Получить дополнительную информацию – http://narcolog-na-dom-ufa0.ru/narkolog-na-dom-ufa-czeny/

Далее начинается этап детоксикации — это основа безопасного и эффективного вывода из запоя. Используются капельницы с современными очищающими и поддерживающими препаратами, комплекс витаминов, препараты для поддержки печени, почек и сердечно-сосудистой системы. При необходимости назначаются средства для стабилизации психоэмоционального состояния, купирования судорог, нормализации сна и снижения тревожности.

Получить дополнительную информацию – https://vyvod-iz-zapoya-balashiha5.ru/vyvod-iz-zapoya-na-domu-v-balashihe

Пациенты, которые обращаются в нашу клинику, получают целый комплекс преимуществ, благодаря которым лечение проходит максимально эффективно и комфортно:

Ознакомиться с деталями – https://narcolog-na-dom-novosibirsk0.ru/narkolog-na-dom-czena-novosibirsk/

Ниже приведена ориентировочная таблица с ценами на основные виды услуг, предоставляемых нашей клиникой. Окончательная стоимость определяется после первичного осмотра и индивидуально согласовывается с пациентом:

Изучить вопрос глубже – vyzvat-kapelniczu-ot-zapoya nizhnij novgorod

Эта статья для ознакомления предлагает читателям общее представление об актуальной теме. Мы стремимся представить ключевые факты и идеи, которые помогут читателям получить представление о предмете и решить, стоит ли углубляться в изучение.

Выяснить больше – https://earthboundrootskratomherbals.net/2016/11/11/aenean-tempus-ac-urna

После поступления вызова наш нарколог выезжает к пациенту в кратчайшие сроки, прибывая по адресу в пределах 30–60 минут. Специалист начинает процедуру с подробного осмотра и диагностики, измеряя ключевые показатели организма: артериальное давление, частоту пульса, насыщенность кислородом и собирая подробный анамнез.

Получить дополнительную информацию – https://narcolog-na-dom-novosibirsk00.ru/narkolog-na-dom-kruglosutochno-novosibirsk/

В некоторых случаях медлить нельзя ни минуты. Запойное состояние чревато обезвоживанием, судорогами, инфарктом, психозом. Если у пациента наблюдаются выраженные физические и психические нарушения, самостоятельное «пережидание» может закончиться тяжёлыми осложнениями.Поводом немедленно обратиться к специалистам становится:

Ознакомиться с деталями – https://vyvod-iz-zapoya-noginsk5.ru/vyvod-iz-zapoya-stacionar-v-noginske

После вашего звонка нарколог выезжает на дом в течение 30–60 минут. Прибыв на место, специалист проводит всесторонний медицинский осмотр, включая измерение артериального давления, пульса и уровня кислорода в крови, а также собирает анамнез для определения степени интоксикации.

Изучить вопрос глубже – http://narcolog-na-dom-voronezh0.ru/

Специалист выясняет продолжительность запоя, характер симптомов и наличие сопутствующих заболеваний. Полученные данные являются основой для составления индивидуальной программы терапии и выбора оптимальных медикаментов.

Подробнее – вызов нарколога на дом в уфе