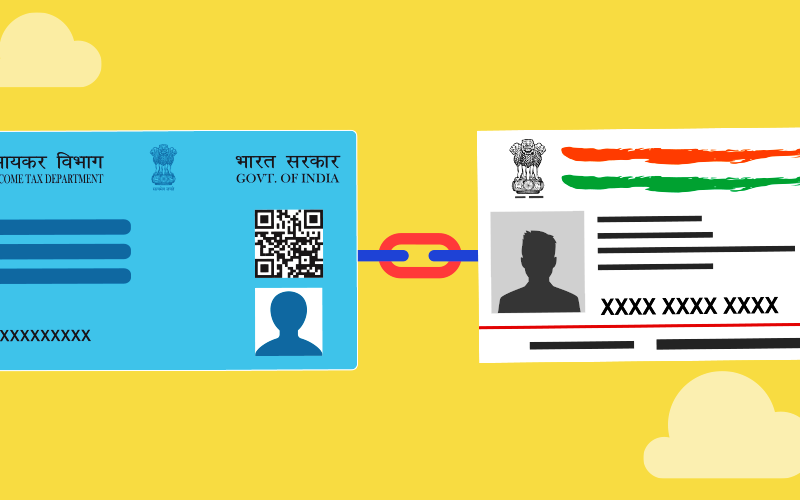

PAN-Aadhaar Card Link Status: Your PAN card will also become useless, if you have not linked your PAN with your Aadhaar card, then this is being repeatedly told by the Central Government and the Income Tax Department. PAN card is such a document, without which many financial related work cannot be done. Especially any work related to return filing and income tax cannot be done without PAN card.

The Income Tax Department has recently informed by tweeting that if you have not linked your PAN with Aadhaar Card, then you will not be able to use the PAN card after March 31. Also appealed to link it. However, if you do not know whether your PAN card is linked to Aadhaar or not, then you do not need to worry at all. With an easy process, it will be known in minutes. After this if there is no link then you can link it.

How to know whether your Aadhaar card is linked with PAN

-

- For this, first of all you have to go to the website of the Income Tax Department or you can also visit this direct link.

-

- Now in the Quick Link section, click on Link Aadhaar Status.

-

- After this you will have to enter 10 digit PAN number and 12 digit Aadhaar card number.

-

- Now click on View Aadhaar Link Status.

-

- If your Aadhaar is linked, then you do not need to link it, but if you do not have a link, then you will have to link it.

What if PAN is not linked to Aadhaar?

If PAN is not linked with Aadhaar, then income tax return will not be received. Also cannot use PAN card and cannot get another PAN card made. This document is also required while filing returns. Many such types of work cannot be completed without PAN card.

How to link pan card with aadhaar

-

- First, go to the e-filing portal and click on the Aadhaar link in the Quick Links section.

-

- Now enter the Aadhaar number and PAN card number.

-

- Go ahead and enter PAN and confirm PAN and mobile number.

-

- Now enter OTP and click on Income Tax File Process.

-

- After this enter the mode of payment and enter the assessment year.

-

- After the payment is made, the PAN card will be linked to Aadhaar.

Read This Also:Under the new tax regime, tax relief has been given to taxpayers earning less than Rs 7 lakh per annum.

Please Visit To Pinfinder.in